All Categories

Featured

Table of Contents

Our price calculator likewise consists of the Waiver of Costs biker for all service providers. Few various other quote devices enable this. Term Insurance Amount Top Firm Annual Month-to-month Type Age Gender $2,000,000 $1,140.72 $96.96 35 Year Degree Term Assured 31 Female $2,000,000 $1,140.72 $96.96 35 Year Level Term Ensured 31 Female $2,500,000 $1,422.00 $120.16 35 Year Level Term Guaranteed 31 Women $4,000,000 $2,218.24 $188.55 35 Year Degree Term Guaranteed 31 Female $1,000,000 $481.40 $40.68 30 Year Level Term Ensured 31 Women The following is a short listing of some of the other elements that you will require to consider when comparing products and companies in the life insurance estimates device: Company Financial Toughness Not all life insurance policy firms coincide.

Some companies remain in much better financial condition than others. The longer the degree term duration, the more essential it is to think about exactly how healthy and balanced and strong the life insurance firm is. Ensure that you ask your agent for info about the economic ratings for the companies that you are taking into consideration.

If two products have the very same price, but one is assured while the various other is not, the guaranteed item would certainly be much better. Renewal Period A lot of degree term policies have the capacity to renew the policy beyond the first degree premium period. 2 products may provide identical premiums for the preliminary level duration, and yet there may be a substantial distinction in revival costs past the level period.

Regular Monthly Payment Choices Several consumers pay their term insurance coverage costs on a monthly basis. The least expensive product based upon the yearly costs might not have the most affordable monthly, quarterly or semi-annual costs. Lots of life insurance policy firms bill additional to pay even more regularly than each year, and some fee much more than others.

A little high blood pressure might invalidate you for one firm's recommended health premium, yet could be appropriate to get another firm's recommended health costs. Smoking Factors to consider Not all life companies define smoking the exact same means.

If you do smoke, some firms might supply items with better premiums depending on exactly how little you smoke, or whether you smoke cigars or pipe instead than cigarettes. You will need to go over every one of this with your agent. The details made use of in this life insurance policy estimates contrast has been extracted from the rate cards and price handbooks which life companies regularly release and distribute to life representatives and brokers.

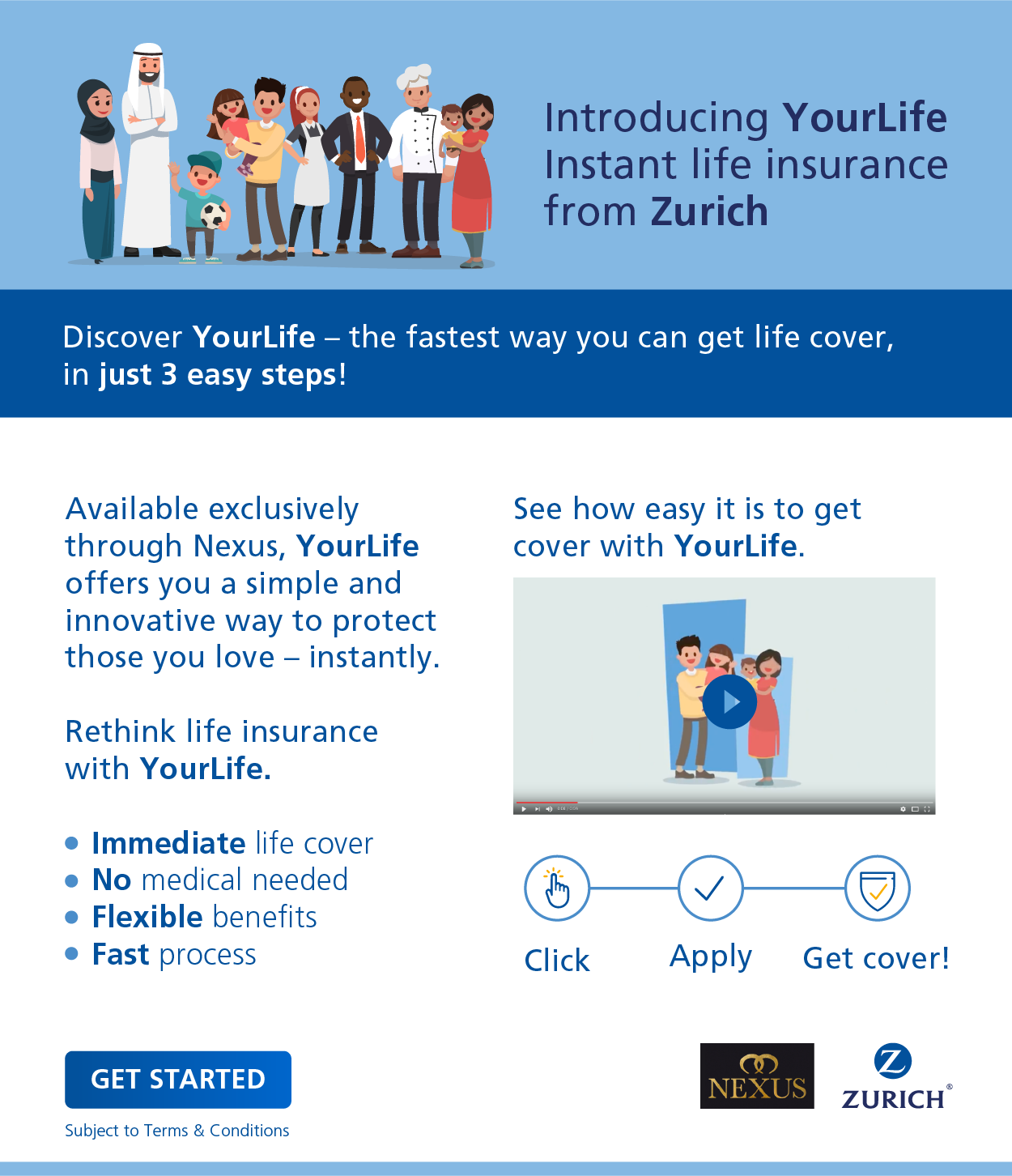

Instant Life Insurance

Nonetheless, In the event that there is a discrepancy between the info included in this comparison, and any type of life business authorized image and/or policy,.

In addition to your age, life insurance rates likewise depends on your health. You get instant life insurance quotes and everything looks great, but you decide to wait on getting a policy.

The lower line in this instance? If you're healthy, do a life insurance policy quote contrast and use currently simply in situation any unforeseen health and wellness difficulties pop up in the close to future that can modify your rates. Keep in mind that insurance providers can alter their prices at any kind of time. In some cases they reduced rates on preferred policies to remain affordable, while other times, they might raise rates for candidates that stand for a better risk.

1 Some whole life authorities do not have cash money values in the first 2 years of the plan and don't pay a dividend up until the plan's third year. 2 Policy advantages are decreased by any kind of superior financing or finance interest and/or withdrawals. Dividends, if any, are affected by policy fundings and finance rate of interest.

Get Instant Life Insurance Quote

This is not an agreement or a deal of coverage. This is a quote based upon individual info that you've supplied and describes certain functions of a common policy, which may differ by state. Insurance coverage quantities and attributes revealed on this quote may not be readily available to you. If a plan is issued, its provisions and pricing may differ from this proposal.

It's possibly less costly than you assume! Among the biggest advantages of term insurance policy is its affordability. The cost for coverage is different for everyone and some might be able to obtain term life insurance policy for as low as $8.24 a month. Just how much your life insurance coverage costs will certainly rely on how much insurance coverage you desire, for how long you require it for, and points like your age and health and wellness background.

When respondents were asked to estimate the expense of a $250,000 term life policy for a healthy and balanced 30-year-old, over half claimed $500 per year or more. In truth, the typical price is closer to $160, which is less costly than the ordinary expense for an annual health club membership. According to a report by Money Under 30, that is around the same quantity you could invest in one commercially ready meal in a dining establishment.

Free Instant Online Life Insurance Quotes

* Protection choices begin at $5,000 and go up to $2 million or even more with eFinancial. Via Progressive Life Insurance Company, insurance coverage choices array from $50,000 to $1 million.

Have additional concerns? Modern Answers is your source for all things insurance policy. See all our life insurance policy ideas and sources.

Any type of unpaid lending equilibrium, plus interest, is subtracted from the death advantage. We encourage you both to consider this protection to assist secure those you leave behind.

Apply online in about 10 minutes. Apply today with self-confidence. If you are not 100% completely satisfied for any type of factor, merely terminate within the very first 30 days and your premium will be reimbursed in full. No questions asked. If fatality arises from self-destruction in the first two years of insurance coverage (one year in ND and CARBON MONOXIDE), we will return every one of the premiums you have actually paid without passion.

Instant Coverage Life Insurance

Before making an application for any type of life insurance coverage, below are a few things you ought to recognize: In order to assess your application for insurance policy, CMFG Life insurance policy Company may ask you to finish concerns on an application. Through these concerns you will certainly give us with medical or other individual details concerning on your own and any type of other individual to be guaranteed.

This added details will certainly help us much better recognize the responses you have actually given on your application. Clinical information we collect about you will not be made use of or launched for any type of function except as licensed by you, to underwrite insurance; to administer your plan; investigate and report fraud; or as called for by legislation.

Box 61, Waverly, IA 50677-0061. With the collection and use of this info we seek to supply you protection at the most affordable possible price. THIS NOTIFICATION IS TO BE READ BY THE APPLICANT FOR INSURANCE. CU-SINOTICE-2004 For citizens of CA, CT, FL, RI and VT: You may name an individual as Second Addressee in the rooms supplied on the application.

If you pick to finish the Additional Info on the application, that person would certainly likewise obtain notice of expired protection in the event your costs are not paid. If you pick to designate a Second Addressee in the future, or alter the person you designated, you may do so at any time by composing CMFG Life Insurance Business.

Latest Posts

Burial Insurance Pro

Insurance Line Funeral Cover

What Is The Best Final Expense Company To Work For